Finance Analytics - the intelligent Credit Risk platform for modern credit teams

- Quickly & easily retrieve credit reports on 500+ million companies

- Monitor credit risk

- Manage large portfolio's

- Automate credit processes and credit decisions

Finance Analytics

Finance Analytics

Introduction

D&B Finance Analytics

The most powerful Credit Management portal ever built

Smart decisions with AI-driven predictions for even less risk

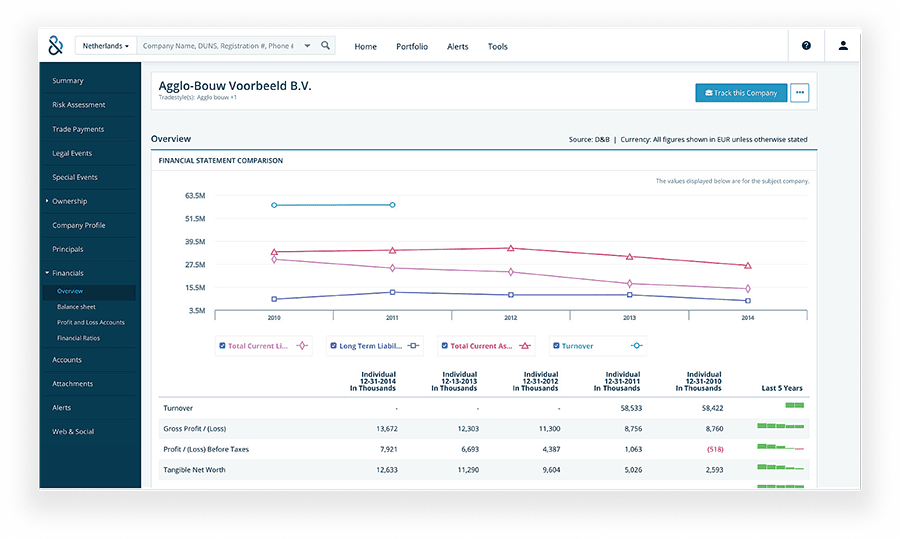

Configurable dashboards and comprehensive charts for in-depth insights

Intuitively designed for effortless navigation and hassle-free ease of use.

Here's how D&B Finance Analytics works

Control and manage credit risk with D&B Finance Analytics

Powered by the Dun & Bradstreet Data Cloud, D&B Finance Analytics provides instant access to industry-leading corporate credit scores, predictive analytics and comprehensive global data. With features such as configurable alerts, portfolio analysis and global consistency in financial statements, this platform enables your credit team to make decisions with confidence and effectively manage your global portfolio.

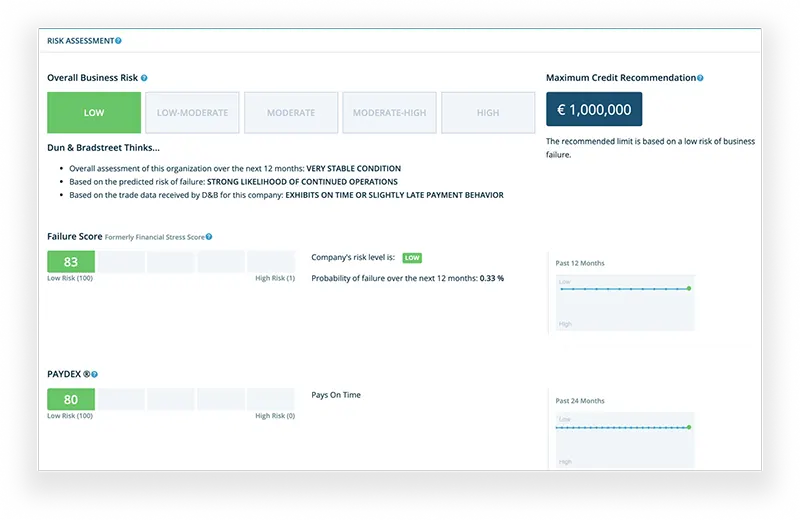

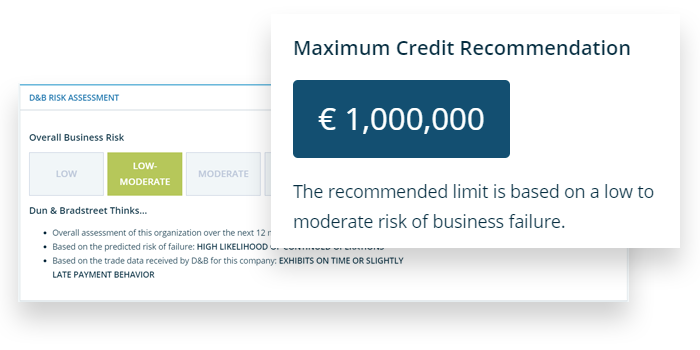

Overall Business Risk

Although each market worldwide has its own risk scores and ratings, Overall Business Risk uses data available locally to create a globally consistent picture that can be used to compare companies in different countries.

D&B Maximum Credit

D&B's maximum credit shows the total value of goods and/or services that the average creditor should have outstanding at one time. This limit is calculated based on organization size, industry (SIC) and risk factor.

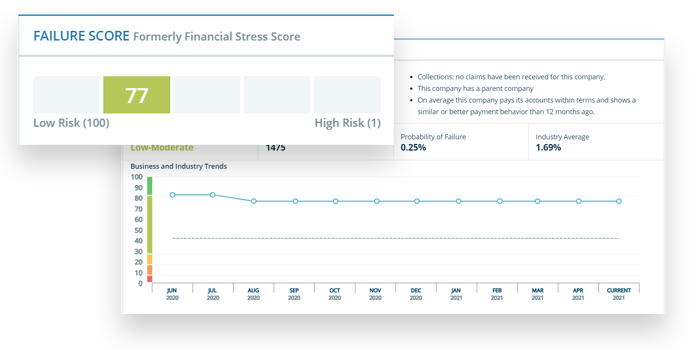

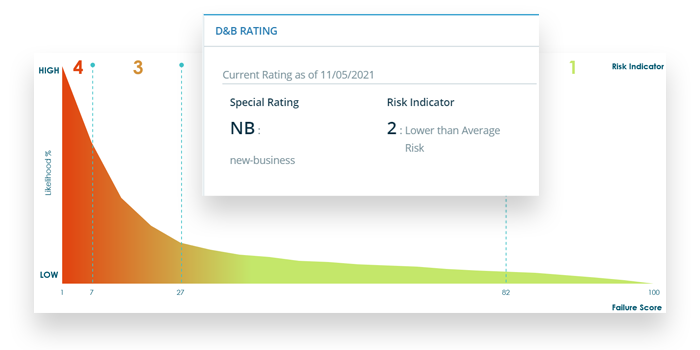

D&B Failure Score

The D&B Failure Score makes risks visible and is based on the largest possible amount of trade information. This score refines the risk scale from 1 to 4 of the D&B Rating to a more refined scale from 1 to 100. The higher the D&B Failure Score, the healthier the status of that company. The D&B failure score is dynamic, meaning that it is recalculated every time we collect a new piece of information about an origination, or when information changes.

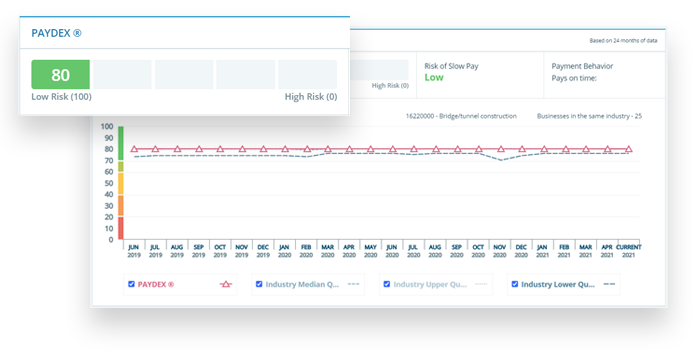

D&B Paydex

Through the Dun-Trade® Program, D&B annually collects millions of payment experiences from companies in order to be able to analyze the payment behavior. The result of this analysis is shown in the D&B Paydex®, which indicates how fast a company pays its invoices. Every day, thousands of current payment experiences are added to the database. This gives the Paydex® rating a very up-to-date insight into the payment behavior of your customers, prospects and suppliers.

De kracht van de D&B Rating

It has been shown that, twelve months before the bankruptcy decision, 75% of the bankrupt companies had a D&B ‘Risk Factor 4’. The Risk Factor warns you at an early stage about possible problems and gives you plenty of opportunity to adjust your terms and conditions accordingly in order to avoid losses.

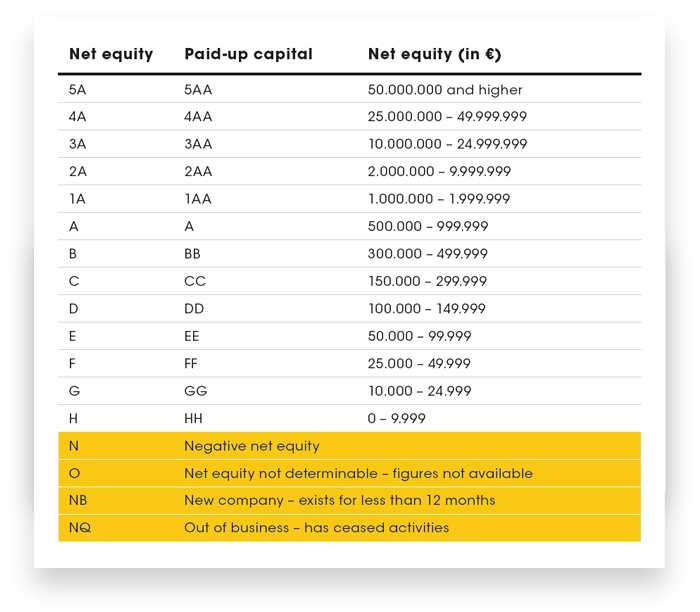

Elementen van de D&B Rating

The D&B Rating consists of two parts, namely the ‘financial strength’ code (based on the net equity) and the ‘Risk factor’ to reflect the risk, when you start doing business with a company. The Risk Factor varies from 1 (minimum risk: continue the transaction) to 4 (significant risk: only do business on a secured basis). This risk indicator is unique in the world of credit.

D&B Finance Analytics - Intelligent risk management for modern credit teams

Facts about D&B Finance Analytics

Finance Analytics

Features

What can you expect from D&B Finance Analytics?

Easy to use

The intuitive interface allows you to easily and conveniently manage the credit risks of your portfolio. D&B Finance Analytics is web-based, so no downloads are necessary.

- Optimized dashboards and graphs to help you better monitor in one view

- Lightning fast, intuitive and user-friendly UI for the best user experience;

- Fully compatible with all modern browsers

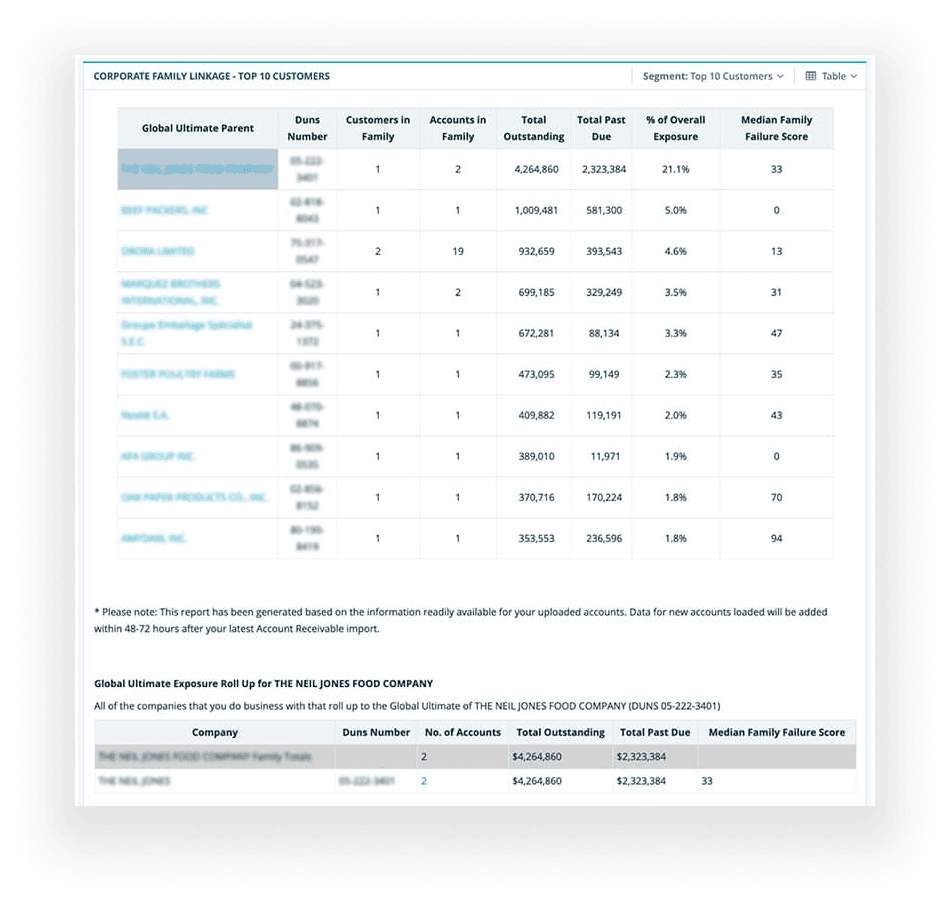

Unravel corporate family structures

The Dun & Bradstreet Family Tree let’s you examine risk across an entire corporate entity, leveraging the power of the DUNS-number in our extensive database of corporate families.

- Visualize the subsidiaries and branch locations within a corporate entity

- Discover total risk in a corporate family and therefore better manage the portfolio

- Assess the size of the company and possible conflicts of interest

- Accurately report on larger suppliers

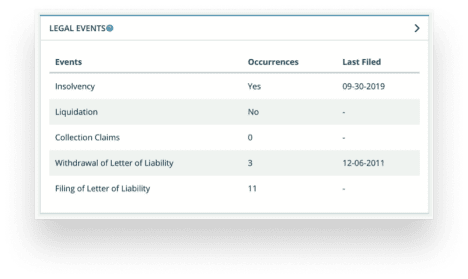

Keep track of legal activities

Past and present legal activities can impact a company’s financial stability and operations. Here you’ll discover lawsuits and resulting court rulings. Dun & Bradstreet is the only credit data provider that offers lawsuit data at an earlier stage.

Examples of legal activities that could affect your business include:

- Insolvency events (such as administration, receivership and bankruptcy)

- Court rulings

- Other public filings

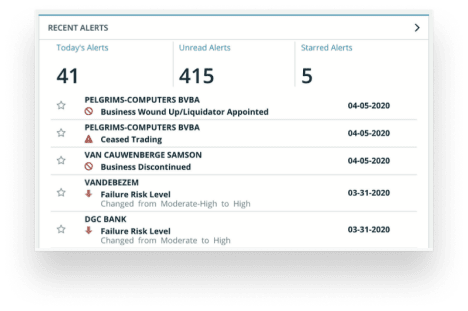

Monitor companies with alerts

You need to know what’s happening with your customers when it is happening, so you can proactively drive the strategy instead of being caught off guard. Receive alerts on accounts and be the first to know when a business has an increasing level of risk. Early notifications allow you to make quicker decisions, so you can focus on the more complicated cases.

- Mitigate risk and manage credit changes through alert profiles

- Monitor your customers’ financial health and protect your business

- Receive notifications via email, dashboards and reports that let you know the moment a business begins to pose a higher level of risk or opportunity

Try D&B Finance Analytics?

Contact us for a demo. We are happy to take the time for you.

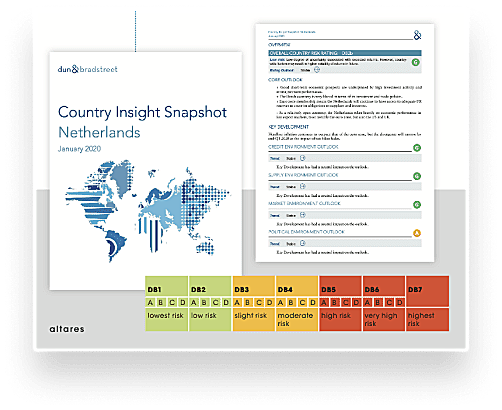

Consult Country Intelligence expertise

Dun & Bradstreet Country Insight Services provides you with the information, insight and expert recommendations to identify opportunities and risks whilst doing business across the globe.

- Easily download a single country snapshot or full report within D&B Credit

- Assess information about 132 countries

- Use the Country Risk Indicator for a comparative cross-border assessment, ranging from DB1 through DB7, where 7 has the highest risk

- Make safe decisions with AAA – the most well-known rating model on the market

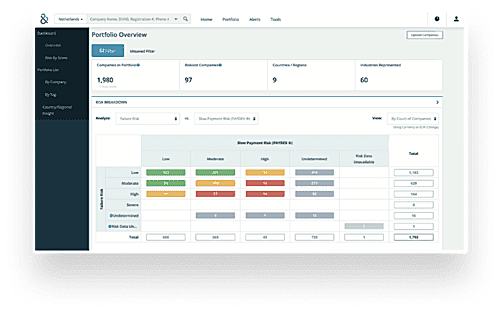

Powerful segmentation within your portfolio

Understand the total risk and identify growth opportunities in your account portfolio trough powerful segmentation capabilities and flexible tagging options. Your entire team will be able to zero in quickly on the right information.

- Easily add customers to your portfolio and organize them by relevant characteristics

- Generate a limitless number of tags to create the segments that help you be more efficient

- View portfolio trends in clear dashboards and clickable summaries

- Simply spot payment trends and discover slow payers or defaulters altogether

- Integrate your own data to create a holistic view of your portfolio

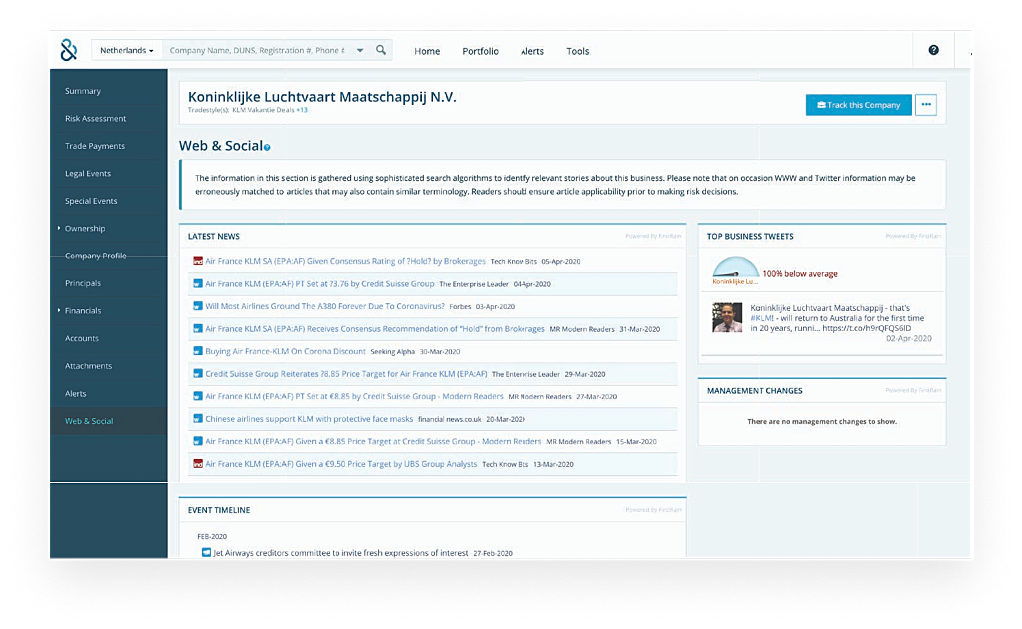

Track social presence and news items

Because companies are often active on social media, D&B Finance Analytics provides additional information from these sources, such as important tweets, online company news and changes in management.

- Third-party web and social feeds integrated into reports, providing real-time qualitative information

- The event timeline provides an overview of the most important developments and events affecting the company

- Identify relevant stories about this company which are collected using advanced search algorithms

- Check social media activities in the top business tweets section

Stream data and analytics into your own applications

With our D&B Finance Analytics for Credit API, you transform the way you do business. You connect risk and financial data into the applications where you need it most. Offer your teams data & insights they need to improve the quality and speed of decision making to drive better business results.

- Access all relevant information within your ERP and accounting applications

- Improve cash flow by reducing credit risk and identifying opportunities across the credit portfolio

- Synchronize the flow of information across all your financial systems for better & faster decisions

- Automate decisions to manage risk, receivables, and collection priorities

D&B Finance Analytics is here to help you

With the leading D&B Finance Analytics

we help you to achieve growth without running more risk or compromising on quality.

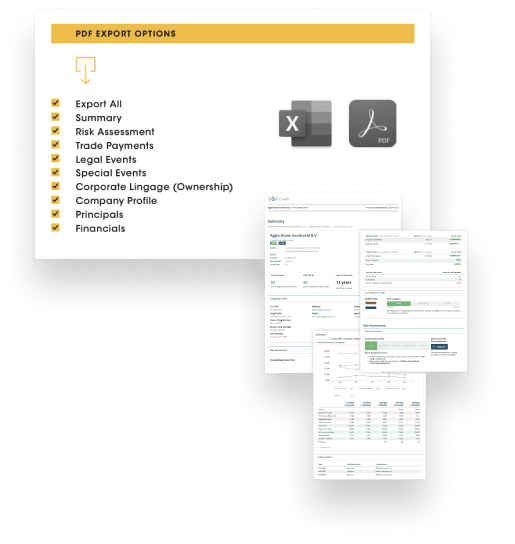

Export options

View reports the way you want to see them and move intuitively from critical summary information to comprehensive information.

- Save snapshots to look back at the previous situation

- Pick and choose which information you want to export

- Easily export to PDF or Excel

Product comparison

Your goals, many possibilities

Achieve your credit management challenges with D&B Finance Analytics.

- Full access to financial health information on 500+ million organizations

- Powerful proprietary scores and predictive indicators to help you understand total potential risk and opportunity

- A cloud-based, intuitive interface that’s easy to use

D&B Finance Analytics | D&B Finance Analytics reporter | D&B Finance Analytics | D&B Finance Analytics Advantage |

|---|---|---|---|

Business Credit Report Acces | |||

Scores & Analytics | |||

Trade Payment Data | |||

Corporate Family Tree Charts | |||

Legal Event Filings | |||

Monitor Accounts with Alerts | |||

Country Risk Report Acces | |||

Manage and Segment Customer Portfolio | |||

Global, Unlimited Credit Report Acces | |||

Personalized Customer Portfolio Management Using Your Own Data | |||

Personalized Customer Portfolio Management Using Your Own Data |

Try D&B Finance Analytics?

Contact us for more information or a demo. We'd be happy to help.

FAQ

I want to automate my customer acceptance process

For a clean, efficient and effective customer underwriting process, you need a reliable source of up-to-date business information. Integrate Dun & Bradstreet data directly into your own environment and automate your underwriting process for fast, informed and consistent decisions. Read more.

I want to assess the risks with prospects

Did a promising lead come in? Good for you! But now it's time to make some business decisions. Are you going to accept him as a customer? Can he buy on credit, and if so on what terms? When making these decisions, use our reliable business information, such as our credit risk data. Then you avoid doing business with companies that actually cannot meet their financial obligations. Read more.

I want to understand the risks of a country's business environment

Altares Dun & Bradstreet's country information informs you of everything you need to know about doing business in a specific country. You will be kept informed of important changes and of expected national developments within a country that may affect your business. Read more.

I want to monitor the developments within my debtor portfolio

By enriching your own client information with valuable Altares Dun & Bradstreet data, you create a clear overview and always know exactly how your client portfolio is doing. Where are your risks and where are your opportunities? Based on this insight you can segment your dunning process and determine focus within your portfolio. Read more.