When it comes to the financial health of companies and bankruptcies, we have a better understanding of the current state of affairs than anyone else. In these special times it is very important to keep a finger on the pulse on the financial health of your buyers and suppliers. The barometer shows the current bankruptcies every month in comparison with previous periods and other sectors.

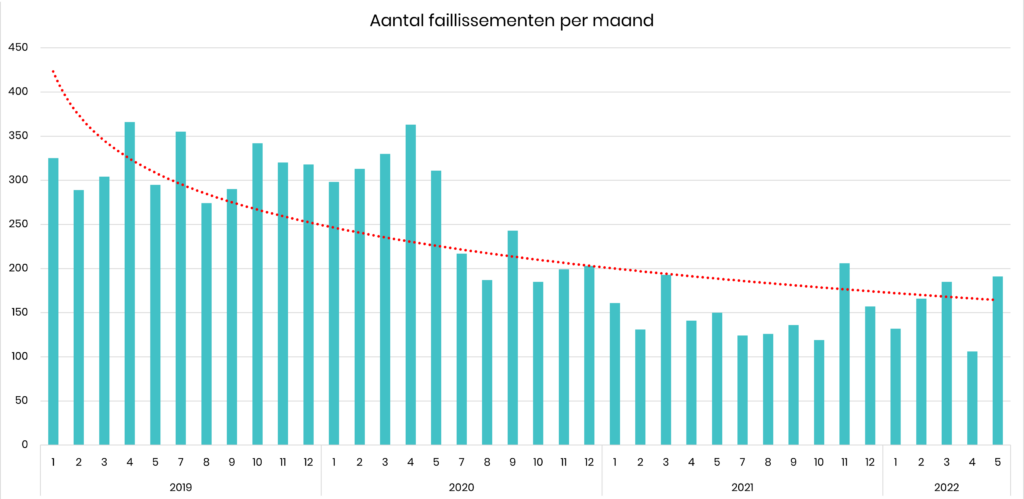

A total of 133* bankruptcies were declared in July 2022 (reference date 8-8-2022). That's 13 less than the number of bankruptcies last month, June 2022 (146), 9 more than the same period in 2021 (124), 84 less than the same period in 2020 (217) and 222 less than the same period in 2019 (355).

With 206 bankruptcies, November 2021 is the month with the most bankruptcies in the past 12 months. Since the beginning of the corona crisis, the number of bankruptcies has been low, even lower than before the corona crisis. This is a result of government support to ensure that normally healthy organizations stay afloat during the crisis. A side effect of these support packages is that financially unhealthy organizations also do not go bankrupt.

*The figures in this report are provisional and may be subject to change.

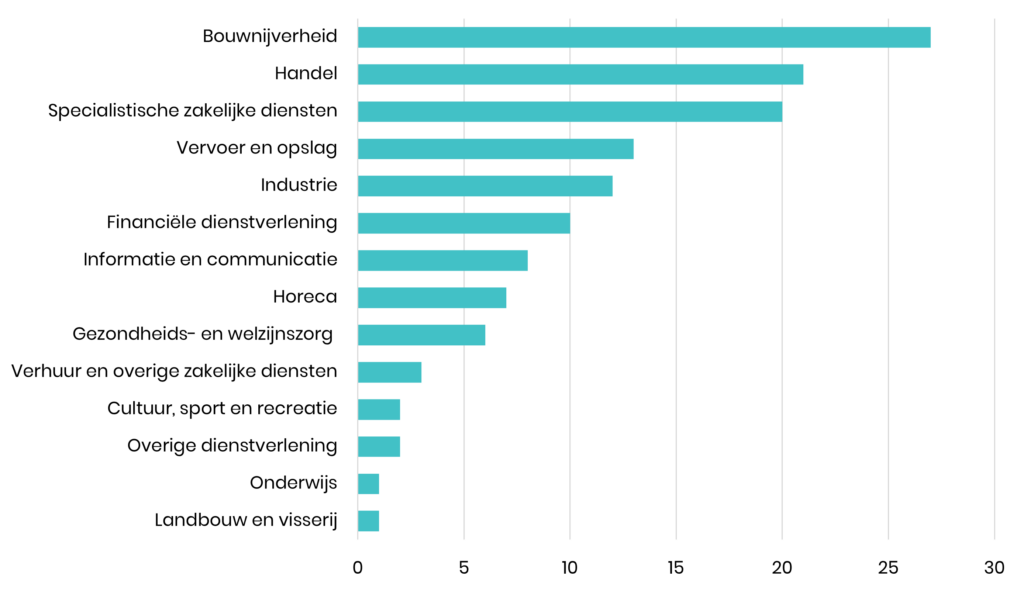

Bankruptcies by sector in July 2022

In July, most companies in the sector Construction went bankrupt, namely 27. The Trade sector also stands out negatively due to the high number of bankruptcies (21).

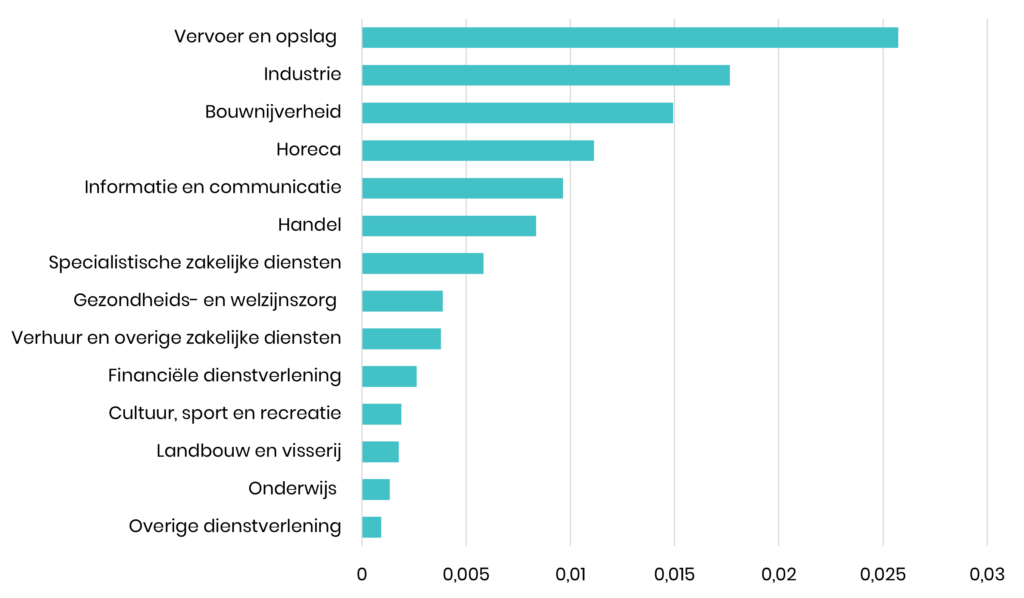

When comparing the number of bankruptcies to the total number of companies in an industry, we see that the hits are mainly in the Transportation and Warehousing sectors, followed by Industry and Construction.

Altares Dun & Bradstreet: your data partner

Altares Dun & Bradstreet helps organizations create a corporate culture that prioritizes data as a strategic weapon. Our Dun & Bradstreet data cloudis an inexhaustible source of information, with insights that 90% of all fortune 500 companies access daily. Do you need help setting up a master data management strategy? Get in touch with us.