Dun & Bradstreet Faillissementenscore

Making good credit decisions is not always easy. To measure and assess risks objectively and consistently, you need a variety of information. The D&B Bankruptcy Score makes risks visible and measurable and is based on the largest possible number of company data. Its calculation method guarantees objectivity and consistency and enables you to reduce bad debt.

RATING & SCORES

D&B Bankruptcy Score

The D&B Bankruptcy Score is:

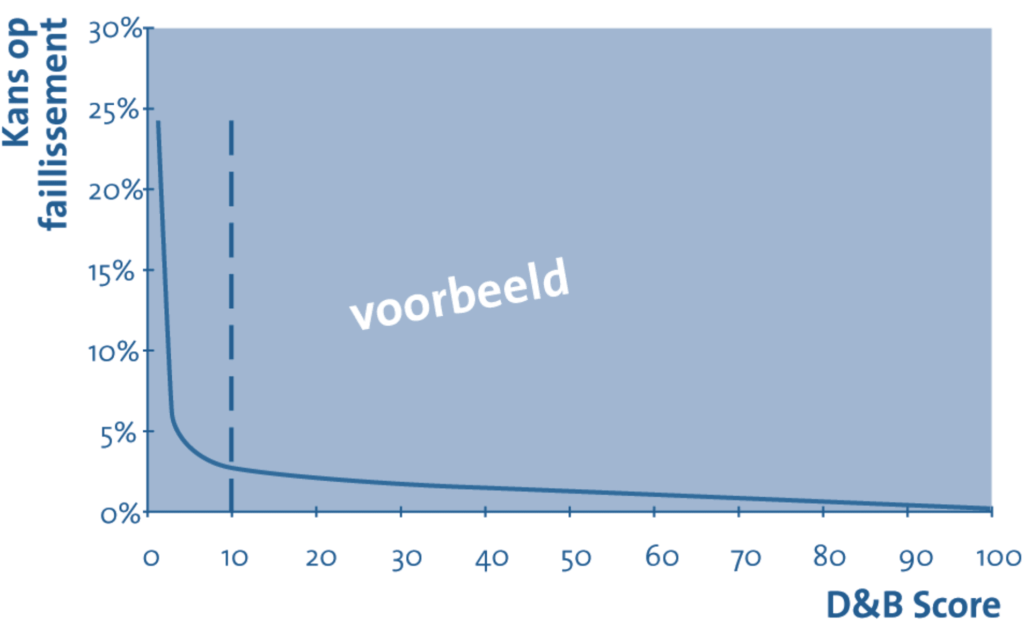

- A dynamic risk indicator of the probability that a company will cease its activities within 12 months.

- A statistically determined and mathematically calculated score according to the rules of the art that predicts business failures.

- A refinement of the D&B Rating, for credit decisions that require a more in-depth analysis, a percentile score on a scale of 1 to 100 that positions a company against all other companies in the D&B database.

- A percentile score on a scale from 1 to 100 which positions a company against all other companies in the D&B database

- A score available for all companies (including companies that do not publish financial accounts) in 24 European countries.

Quick and easy to interpret

Calculating the D&B Bankruptcy Score.

The D&B Bankruptcy scores are recalculated daily. Every six months, the Score Model is evaluated for effectiveness and adjusted if necessary. The D&B Bankruptcy Score is country-specific: a score was developed for each country on the basis of the available data in that country.

The benefits of the D&B Bankruptcy Score

- Faster decision making – by basing your credit decisions on the D&B Bankruptcy Score, you can effectively reduce the time required to process applications.

- Better decisions and reduced exposure to non-recoverable debt – the finer scale of the D&B Bankruptcy Score allows you to make more accurate decisions and thus better protect yourself from badly paying customers.

- Increased efficiency and productivity – By automating the easy or standard applications (about 70% of all credit decisions!) you can focus your attention and time on investigating the more difficult cases.

- More consistent and objective credit decisions – By using the D&B Bankruptcy Score for your credit decisions, you can improve the consistency and objectivity within the decision-making processes.

- Effective management of your portfolio – The D&B Bankruptcy Score makes the risk visible and measurable. This enables you to better assess, map and manage the individual and global risk of your debtor base.

Automate using the D&B Bankruptcy Score

Customized solutions for automatic creditworthiness check and fraud indicators in customer acceptance (NL)

What can we help you with?

I want to be able to assess the risks with prospects

Did a promising lead come in? Good for you! But now it's time to make some business decisions. Are you going to accept him as a customer? Can he buy on credit, and if so on what terms? When making these decisions, use our reliable business information, such as our credit risk data. Then you avoid doing business with companies that actually cannot meet their financial obligations. Read more.

I want to map my market and market potential

Knowledge and understanding of your market is critical to your success. The Dun & Bradstreet Data Cloud is the largest of its kind and allows you to conduct comprehensive analysis, understand your market share and market penetration, and uncover growth opportunities.

How many companies are there actually within a particular region and how big are these companies? How many companies are active within a specific branch and how many people are employed there? You can quickly and easily make counts and selections in D&B's international companies database on the basis of many criteria. This gives you an insight into where you can best focus your efforts and where your chances of success are the greatest. Read More

I want to integrate Dun & Bradstreet data into my ERP system

By integrating our rich database into your ERP system, you can benefit in many ways. For example, you clean up and keep your data clean throughout your organization. You can validate and enrich your customer and prospect information directly from your business application. Current information becomes instantly accessible within your ERP and you can use it to automate your acceptance process and improve scoring model. Read more.

I want to identify a stakeholder (UBO) of a complex organization

Almost 70% of Dutch BVs are linked via shares to another company in the Netherlands or internationally. More than 30% of Dutch BVs and NVs have a link to foreign companies. The Dun & Bradstreet Data Cloud is the most complete and reliable source for insight into the Dutch and foreign relationships of your business partners, ranging from small unknown companies to the largest multinationals with thousands of branches. Read more.

I want to understand and monitor the risk in the total supply chain

An initial check when selecting a supplier is not sufficient. It is then important to make all changes in risks transparent and to monitor them. This keeps you informed exactly how the risks in your total supply chain are developing. Only with this information can you correctly assess all risks within your portfolio. Read more.