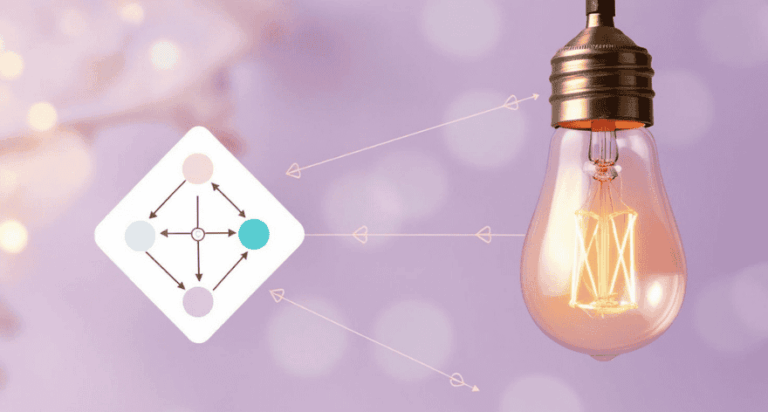

The matrix of marketing insight and commercial blind spots

Many organizations think they are data-driven, but lack critical insight into their commercial assumptions and blind spots. This matrix helps you identify six data zones, from what you're sure about to what you'd rather not face. By being more aware of your data, you'll make better decisions and discover untapped growth opportunities.